‘Sin Tax’ or Just Another Money Grab? The Rising Taxes on Alcohol, Tobacco, and More

Governments claim high taxes on alcohol and tobacco promote public health, but are they just using "sin tax" to fill their coffers? A deep dive into the growing taxation burden on everyday consumers.

Introduction: Public Health or Revenue Generation?

Every time the government raises taxes on alcohol, tobacco, or sugary drinks, they justify it as a ‘public health’ measure. The idea is simple: making these products expensive will discourage consumption and improve public health.

But is that really the case? Or is the government simply using "sin taxes" as a convenient way to extract more revenue from consumers?

From rising excise duties on liquor to higher GST rates on pan masala, India’s taxation policies on so-called “harmful” products have become a massive cash cow for the state. Instead of reducing consumption, these policies drive black markets, hurt businesses, and burden consumers.

How ‘Sin Tax’ is Structured in India

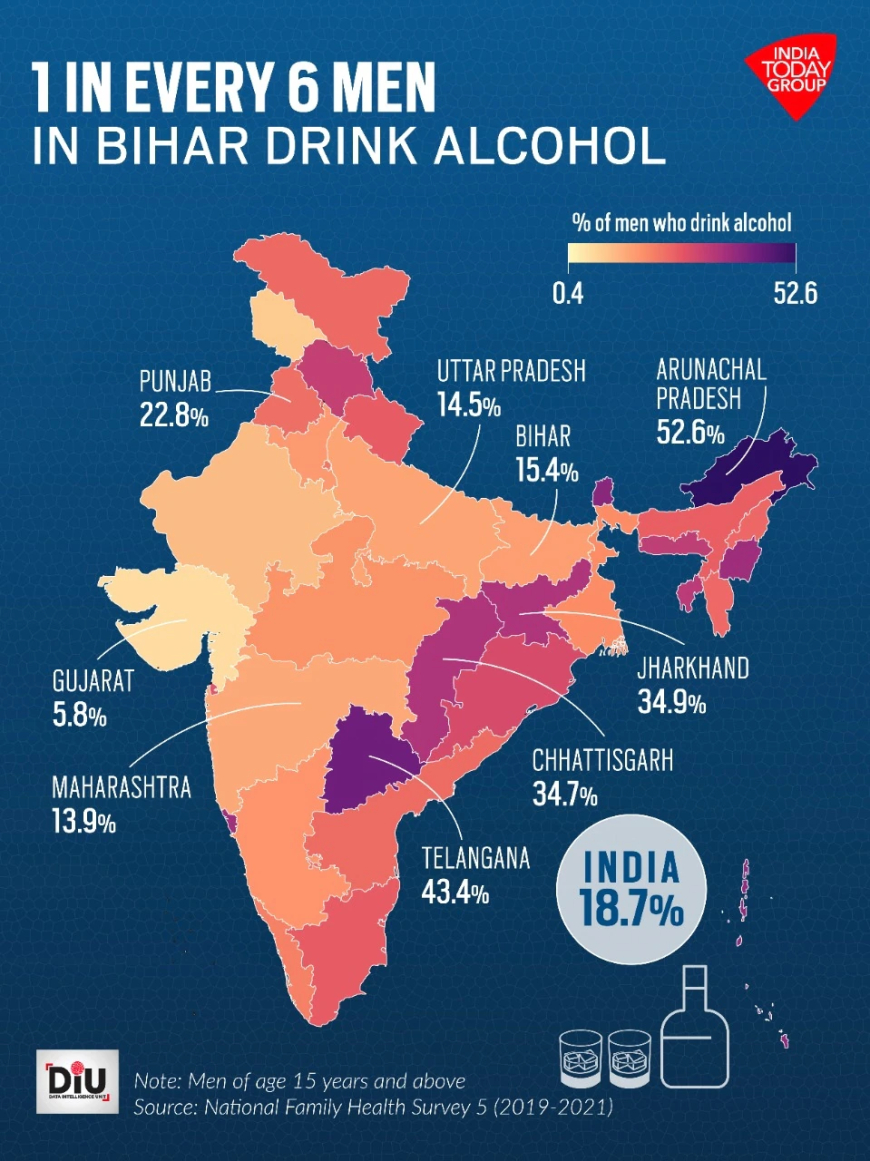

Alcohol: The Government’s Biggest Cash Cow

Alcohol is one of the most heavily taxed products in India, with taxes varying across states. In some states, taxes account for 60-70% of the retail price of liquor.

- Excise Duty: The biggest contributor to state revenue.

- Value-Added Tax (VAT): Different in every state, ranging from 10% to 35%.

- Additional Cess & Special Fees: Applied by some states, further inflating prices.

Despite generating massive revenue, governments keep increasing alcohol taxes under the guise of discouraging drinking. But instead of reducing consumption, this has boosted illegal liquor markets, leading to increased instances of toxic bootleg alcohol poisoning.

Tobacco: The Never-Ending Tax Hikes

Tobacco products, including cigarettes, bidis, and chewing tobacco, are taxed at the highest GST slab (28%), with additional cess up to 290%.

Recently, the government raised GST compensation cess on pan masala and gutkha, making them even more expensive. But the irony? The bidi industry, which caters to lower-income smokers, continues to enjoy tax exemptions due to political lobbying.

Instead of preventing smoking, high tobacco taxes have fueled smuggling, with illegal cigarette brands flooding the market. As much as 25% of the tobacco market in India is now illicit, causing revenue losses while failing to curb consumption.

Sugary Drinks & Junk Food: The Next Target?

In 2023, the government proposed higher taxes on sugary drinks, citing rising obesity and diabetes cases. Carbonated drinks already face a 40% tax burden, but health activists want an additional "sugar tax" to be imposed.

If implemented, this will:

- Increase prices for everyday consumers.

- Hurt small retailers and street vendors.

- Push people toward unregulated alternatives.

Why ‘Sin Tax’ Doesn’t Work

1. Black Markets and Illegal Trade

History shows that higher taxes don’t stop consumption—they just push sales underground. Prohibition-era America saw a rise in bootlegging, and India’s liquor and cigarette smuggling has surged as taxes increased.

2. Burden on Middle-Class and Low-Income Consumers

Higher taxes disproportionately affect working-class consumers, who spend a larger portion of their income on these products. The rich will always afford expensive liquor and branded cigarettes, but for the middle class, these taxes hurt.

3. Governments are Addicted to ‘Sin Tax’ Revenue

If the government truly wanted to reduce consumption, why does it rely so heavily on alcohol and tobacco taxes for revenue?

- States like Uttar Pradesh, Maharashtra, and Tamil Nadu make 15-25% of their revenue from liquor taxes alone.

- If people actually stopped drinking or smoking, governments would lose thousands of crores in revenue.

This proves that sin taxes are not about public health but about making easy money.

The Libertarian Solution: Let Consumers Decide

Instead of punishing consumers, a true free-market approach would:

- Reduce excessive taxation on alcohol and tobacco.

- Allow businesses to compete fairly without government interference.

- Encourage consumer awareness through education, not force.

Heavy taxation and government control have never solved public health issues. Let individuals make their own choices instead of being forced into government-decided lifestyles.

Conclusion: ‘Sin Tax’ is Just Another Money Grab

Whether it is alcohol, tobacco, or sugary drinks, governments use taxation as a weapon, pretending it’s for public welfare while filling their coffers. Instead of over-taxing consumers, it’s time for India to move towards lower, fairer taxes and consumer freedom.

Do you think “sin taxes” are justified, or are they just a way for the government to take more of your money?

What's Your Reaction?