The Great Indian Tax Chase: How Every Entrepreneur Faces the Bureaucratic Dragons

Explore how India's complex tax and regulatory systems stifle entrepreneurship. Discover how a free-market approach can empower innovators and fuel economic growth.

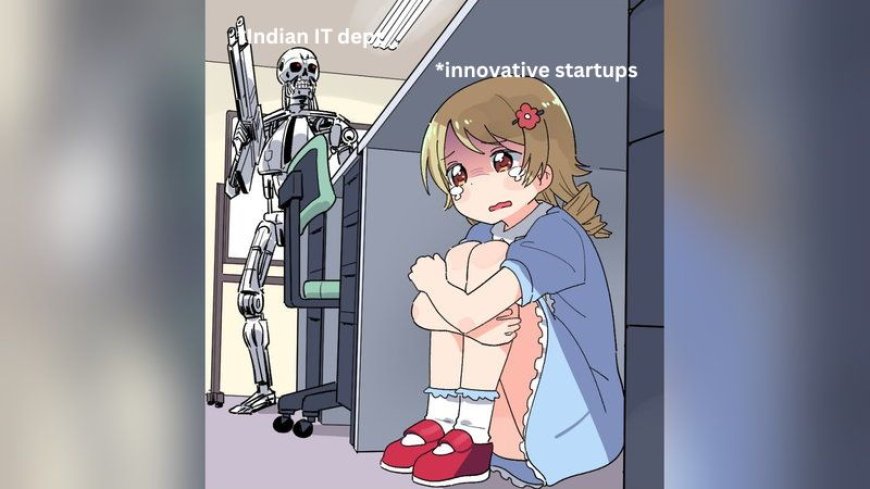

India, the world’s fastest-growing major economy, has long been heralded as a land of opportunity. From its booming tech hubs to its vibrant startup ecosystem, India seems to promise endless possibilities for innovators and entrepreneurs. However, lurking beneath this vibrant surface lies a labyrinth of taxes and regulations that often feels more like a punitive game of survival than a supportive environment for business.

The Tax Hydra: A Never-Ending Battle

For Indian entrepreneurs, taxes come in every shape and size. The Goods and Services Tax (GST), introduced as a revolutionary reform, still poses significant challenges. While it was meant to unify and simplify the tax structure, the reality is a maze of multiple slabs, constant filings, and compliance burdens. Small business owners often spend more time navigating tax codes than scaling their ventures.

But GST isn’t the only culprit. Entrepreneurs face tax challenges at every level:

- Professional Tax: Levied on employees but managed by employers, adding administrative load.

- Property Tax and Local Levies: A hidden burden for those renting or owning business spaces.

- Excise Duties and Import Tariffs: A nightmare for those in manufacturing and import-heavy industries.

Regulatory Paralysis: The Bureaucratic Dragons

Apart from taxes, regulations remain one of the largest roadblocks for Indian entrepreneurs. Compliance requirements for businesses are often opaque, outdated, and riddled with inefficiencies. A small error in paperwork can result in punitive fines or delays that derail operations. The red tape disproportionately affects small and medium enterprises (SMEs), which lack the resources to hire consultants and legal teams to handle these hurdles.

India ranks 63rd in the World Bank's Ease of Doing Business index (2020)—a significant improvement over previous years but still reflective of how much work remains. The startup ecosystem, though thriving, continues to be weighed down by excessive licensing, registration fees, and sector-specific approvals.

The Toll on Innovation

One of the biggest casualties of this tax-and-regulation maze is innovation. Entrepreneurs are forced to prioritize compliance over creativity, resource allocation for tax filings over research and development, and administrative burdens over customer needs.

The data paints a grim picture:

- High compliance costs deter startups from scaling beyond a certain point.

- Delayed refunds under GST create cash flow problems for businesses.

- Sector-specific taxes and restrictions make industries like manufacturing less competitive.

What Libertarian Principles Offer

India’s regulatory and tax challenges stem from a central issue: government overreach. Libertarian principles offer an alternative—an economic environment where government interference is minimal, allowing market forces to function freely.

Here’s how simplifying India’s tax system and deregulating industries could revolutionize entrepreneurship:

- Flat, Transparent Tax Rates: A simplified GST structure and reduction in compliance paperwork could significantly ease the burden on SMEs.

- Privatized Support Systems: Private companies handling business facilitation processes could eliminate inefficiencies in registration and licensing.

- Incentives Over Penalties: Rewarding innovation through tax breaks or fast-tracked regulatory approvals can encourage growth and risk-taking.

The Way Forward

For India to fully unleash its entrepreneurial potential, it must untangle the red tape that binds its innovators. A simplified tax system and reduced regulatory burden would not only empower startups but also attract global investment, driving economic growth for decades to come.

India’s entrepreneurs aren’t asking for a handout. They’re asking for the freedom to create, innovate, and compete. By letting go of bureaucratic micromanagement and embracing the principles of a free market, the government could turn the dream of a thriving, entrepreneurial India into a reality.

What's Your Reaction?